AF tax coaching: 100K real estate Youtuber Alex Fischer becomes tax coach?! Experiences and rating

Germany’s biggest real estate YouTuber launches his “Next Level Tax Coaching”. For weeks, Alex Fischer (Germany’s biggest Youtuber for real estate & finance) has been publishing new videos on his channel: However, on taxes and tax optimization. Reason enough to test the new tax coaching in detail. Otherwise, I write here in the social media blog about marketing, strategies for gaining reach – today it’s about a tip that I just want to give you, as loyal readers. Of course, I know there are many, very entrepreneurial readers here on the blog, like you. That’s why I also thought: we should discuss the topic of tax optimization today. More specifically, tax tips and experiences from AF Tax Coaching. Over 2,500 subscribers in the last 12 months – I’ve taken Alex Fischer Tax Coaching and here’s my review.

Field report: AF Steuercoaching – Foreword

Why did I do the “Next Level Tax Coaching”? Primarily, I’m not interested in lowering my personal income tax. I want to know overarching, in-depth, and most importantly, proven and legal tax reduction tips.

Maybe you feel the same way – Anyone who pushes their own e-commerce through social ads or plans campaigns, who designs media and who is responsible for what happens in large corporations, pays taxes. It doesn’t matter if you’re an entrepreneurial employee or an entrepreneur yourself. Taxes are a huge item (when you add up all your taxes) and your tax burden will always increase as you earn more – which I’m sure you want.

Here you can get directly to the coaching and also other participants’ experiences.

- AF Steuercoaching – Application

- AF Coaching Experiences – Participant Interviews

Media reports at Ntv, FIV and Wallstreet Online. But, who are we actually talking about, Who is Alex Fischer? What is tax coaching all about?

What is tax coaching, very very briefly, about?

Anyone who earns millions with real estate AND has managed to open the largest YouTube channel in Germany for such a complex topic as “real estate and finance” AND who has written a bestseller with over 200,000 readers – knows how it works: tax optimization. Even better: optimize taxes and convert them into private assets.

Sound like work? It is / it will be! Contrary to what I thought at the beginning, tax coaching is not only more time-consuming, but also more extensive than I thought. If tax optimization were easy, everyone would do it.

A word in advance: it’s not worth it for everyone, but what you learn is unbeatable knowledge that only the big corporations know.

Conversely, you can use this knowledge to convert taxes into private wealth.

Problem: Tax consultant and his know how

My original and personal motivation for tax coaching: my tax advisor. To put it more precisely: his lack of advice, or rather, the lack of optimization. Do you know this too? He and his tax firm are tax administrators, they don’t design, how could they. They staple our receipts and file and account for them – simply put. To the question: why doesn’t my tax accountant help me optimize my taxes?

He can’t.

Reason 1) is the education and the purpose of the profession and reason 2) your always, absolutely individual constellation. To put it very simply: Are you buying a property privately or through an existing or even new company?

Basic problem: Bad tax advisors & compliance<

The problem of many entrepreneurs and self-employed people is a bad tax adviser. One of the reasons for this is their education. The state is responsible for this. A close look at the training makes it clear: tax structuring and optimization is, contrary to what some people expect, not part of the core curriculum. Instead, tax returns and balance sheets are mainly on the timetable. And so many clients who go to their tax advisors with questions and suggestions are often dispatched with the same answers. Not only that: most entrepreneurs hardly know anything about taxes themselves and hand this task over to their tax advisors full of confidence. “Big mistake”, means Alex Fischer. Contrary to the occupation name, tax advisors offer namely no consultation, but Compliance. This means nothing other than compliance with the law and the rules.

- The training to become a tax advisor is subject to the state

- No tax structuring in the curriculum

- Conformity to rules instead of advice

First of all, I didn’t naturally go looking for opinions and reviews.

What does the community say about Alex Fischer’s tax coaching?

In the first part of my internet research, my #1 goal was testimonials from former participants.

With phrases like “impress my accountant”…. Impress my tax consultant with real (!) expertise, exactly my goal.

After all, as Alex Fischer has said in several videos and interviews, no one knows your professional and personal situation as well as you do. So my mission: I want to learn the tax game.

Application, initial interview and decision

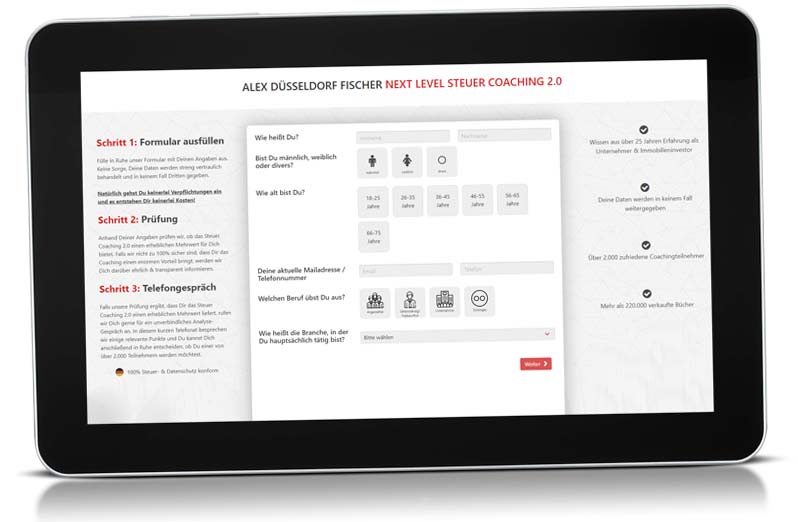

Before I started with the tax coaching, I did some research, read testimonials and took a close look at Fischer’s website. Besides his book, a podcast and his regular blog, I finally found the application form for the tax coaching.

What’s striking here: Unlike many other coaching programs, you have to apply first!

Application and form

What? Why? In fact, participants are selected here. Alex Fischer’s tax coaching is not a “simple tax course”, here strong personalities come together who want to work on creative tax solutions with entrepreneurial interest, after all, the tax coaching also includes two live events. So space is limited and participants should have real will.

Spoiler: This also extremely benefits the live events. As I’ll tell you in a moment, the others from the AF tax community were extremely interesting and cool people, from master craftsmen to doctors. Yes, there were tax accountants on site too!

Initial interview: What’s it about?

Since the conversations are quite individual, here’s just a quick teaser for you:

The application was followed by an initial interview, where I was not only able to ask my questions, but also had to explain my current tax situation – the whole thing obligation-free, of course. Why the analysis interview? It allows the Alex Fischers team to get a better overview of my qualifications and to assess whether tax coaching would really help me.

Understandable, I think.

You probably guessed it: I got a ticket!

So I can give you a few more, real insiders from AF tax coaching right now!

Foyer (event location in Düsseldorf):

Prominently located, close to the famous Königsallee.

Why did I do the AF tax coaching?

I’ve been following Alex Fischer’s YouTube channel for a while now. I’ve also stumbled across his book “Reicher als die Geissens” (Richer than the Geisses) and his podcast a few times in the past. There has been a lot of talk here about the tax piano and the “tax game” in particular. I wonder if my tax advisor was familiar with that as well. The answer: a matter-of-fact No. The solution: expert knowledge is needed. Because most entrepreneurs, like me delegate their tax activities. Instead, you should become active as an entrepreneur yourself and give the tax know-how you have learned here to your advisor, says Alex Fischer in one of his videos. And especially when looking at my future, I realize:

I don’t just want to save taxes. But also to build up stable assets from this money.

Next Level Tax Coaching: Structure, Participants & Speakers<

How to become a tax professional? Someone needs to analyze my situation, identify knowledge gaps and provide targeted information: Principle Tax Coaching. A special lexicon explaining important terms and ‘orientation maps’ without jargon was created for coaching, just as additional modules with catch-up information were developed for individual participants. Means, the complex “tax-speak” of tax consultants in simple, understandable words.

The approach: increase knowledge. When conveying the knowledge content, as with the structure, not only is the different personality types of the participants taken into account, but also the different knowledge gaps. The whole thing is also available – apart from the live events – as an online knowledge database, quasi to-go.

Everyone can dive as deep as is helpful for themselves

It is important to Alex Fischer that every participant really learns something during the coaching and thus benefits from the new tax knowledge even decades later. Advertising slogan? No. Alex’s bestseller, which I have read of course, had 200,000 readers. All content is always aimed at long term wealth building. This is not about 1, 2, 3 tax saving tips, but about structuring companies, as well as acquisitions and their identities – but that would already go too deep for this experience report.

View from the audience to the stage and speaker Alex Fischer:

Complex things simply explained and step by step into the complexity.

This is what almost 400 participants look like!

My way to becoming a tax professional: webinars & individual discussions with experts<

After acceptance from the Alex Fischers team, the coaching already began for me. To learn how to play the fiscal piano, of course, not just an online course is enough. Instead, Alex Fischer also puts a lot of emphasis on implementation vouchers, question rounds and personal meetings with the speakers.

So the building blocks of coaching are many and varied:

- Lifelong access to an online academy

- Live webinars with different speakers

- Join the exclusive Facebook group Alex Fischers

- Live events at the beginning and end

- Personal conversations to network

- Implementation packages to take home

- Expert vouchers for personal strategy development

You can also talk to Alex Fischer in person at the live events:

Participants: From the board of directors to the master craftsman

While I was able to acquire the rough tax knowledge through the video seminars, I finally got to know the other participants personally at the big closing event with Q&A session. Who thinks that this is a cozy get-together with cookies and cake, is wrong.

Almost 400 people met at the Hotel Intercontinental

Almost 400 people met at the Hotel Intercontinental to get to know Alex Fischer and his team of experts in person. Among the other participants were many entrepreneurs and self-employed, master craftsmen, investors, doctors and lawyers. The common thirst for knowledge at such an event unites and thus led to an exuberant and motivating atmosphere.

Of course, a selfie is not to be missed!

The wide-ranging specialist team of Alex Fischer

Of course, the in-person conferences and events aren’t just Alex Fischer and his team. After some time, a row of tables at the entrance caught my eye. These are experts, specially commissioned by Fischer for this purpose, who are available to his coaching participants for individual concerns. At the expert tables there are, among others:

- Lawyers

- Foundation experts

- Holding Consultant

- Tax consultant

- Contract Lawyer

Here, too, my individual questions were answered with patience and any last scepticism about the highly praised tax coaching was put to rest. So that I can also benefit from my new tax know-how in the future, I was finally given a black cloth bag to take home – a “sustainability and implementation package” Alex Fischer calls it with all the tools and plans inside to support me in my next tax planning. I also find reference books, documents and templates for my tax advisor in my implementation pack. The motivation is summarized for me by one of the attendees:

Our goal is for our participants to recoup their costs by a factor of at least three within the first year.

Makes sense, I think to myself. And with the business cards of other participants in one hand and my black cloth bag in the other hand I feel well prepared for this.

The Intercontinental in Düsseldorf (you can find photos at the beginning of the article) with its large rooms and atmosphere offers the perfect place to make contacts and get into the tax game.

Late in the evening, the topics and conversations become more intense and information-dense (don’t forget a notepad!).

Expertise : Real Estate Investor & Tax Guru

Before I summarize the core topics of the Coaching to you, here once completely briefly Alex Fischer in the Portrait: Born as son of two teachers with 0& own capital it is considered meanwhile as one of the most well-known real estate investors and tax Coaches of Germany. In its 25 Jährigen career, so Fischer, it bought already over 2,000 dwellings, reorganized and so also again sold. Its private real estate existence at a value of 20,0000 square meters is located Duesseldorf, exactly like its office. He acquired his knowledge of real estate and taxes himself and now passes on his tips and tricks to people like me who are thirsty for knowledge. Here is a brief overview of the biggest coaching topics.

Watch out for tax traps: Joint Ventures, Investments & Corporations

In addition to the big mistake of delegating one’s tax responsibilities, there are plenty of other examples of tax traps that many a high earner or entrepreneur steps into on a regular basis. One example is a joint venture. If you choose the wrong form of company, you can end up with high taxes. This is also the case when selling. With the right tax rate you learn here how to pay only 1.5%. The basic principles behind this were also clearly explained to me at the seminar.

If you do it right, you only have to pay 1.5% tax

It is also worth thinking twice when buying a property. If you buy it privately or in a corporation, the tax rate changes here as well. As a well-known real estate investor, Alex Fischer is very knowledgeable and provides extensive advice before it comes to escapades in the settlement and these expensive consequences behind. The same applies to investments.

Tax structuring: the right combination for ultimate wealth creation

In order to avoid these and more pitfalls, the coaching places a great deal of emphasis on the skilful combination of several types of design. These, it is explained to me, always have their advantages and disadvantages. What looks like a small decision at first, adds up later and so, if I combine cleverly, I can save taxes. In order to make this tax game simple and yet effective for his participants, Alex Fischer’s main focus is on overriding principles, strategies and “basic laws”. Formalities and the “typical” paragraphs that every tax advisor knows are rather further down the priority list.

Design types are combined in such a way that the disadvantages cancel each other out and as many advantages as possible are left over

The Pareto Principle applied fiscally: Setting priorities

One of the basic rules that Alex Fischer values is based on the well-known Pareto principle: You only need to have understood the important 20% that cause 80% of the results. Only in this way does an entrepreneur become a strategically thinking and fiscally intelligent entrepreneur – the goal of coaching.

Cause 80% of the results with 20% of the right knowledge

During the expert discussions it becomes clear: This important 20% is mostly reserved for large corporations. And through the various expertise of the speakers, it is passed on to me, as a participant of the coaching, by means of concrete examples.

Short insight into the first weeks: Lots of know how and … Tax shifts!

As I said before, the coaching was specially designed to benefit every participant from day 1. So the first week starts with an easy introduction to the topic of taxes – perfect for an ignorant freelancer like me:

- The tax game & its rules<

- Origin & purposes of taxes<

- Which taxes bring in the most revenue?

- What is tax planning?

- Convert taxes & duties into private assets<

///TIP – Bracket

Alex Fischer’s knowledge is composed of tax, entrepreneurial and investment know-how. In addition, the topics of asset building, lending and transfer are also adressed. Asset protection and building also play an important role. Using the free cash from tax deferral is especially helpful for the latter. The money saved here thus becomes equity and one then uses this for an investment:

“I used to think that tax deferrals were just a ‘nice-to-have’ if you’re not that liquid right now. But in fact, tax deferrals in Germany are an incredible wealth-building accelerator.”

Conclusion: Taxes are a matter for the boss

I was able to benefit from my newly learned tax knowledge not only privately. I was also able to give my tax advisor a few things to do and now have more control over what happens with my hard-earned money. I was also able to make professional contacts with like-minded people through the events and the Alex Fischers Facebook group. As a medium-sized entrepreneur, I am happy that Alex is passing on his knowledge to me and sharing his network of entrepreneurs, lawyers and investors with me.

Related links: Alex Fischer

Learning from real estate investor, the best way to learn taxes online. Here are 2 more extremely good tips, the 80% of his knowledge about tax optimization and finance Alex Fischer gives for free on Spotify, iTunes and YouTube. Yes, for free.

Do you already know his bestseller

In fact, I devoured this book. Alex Fischer is an expert on taxes. His book has over 200,000 readers, for good reason. It’s also in the top 100 on Amazon! In a nutshell, you get 43 timeless laws of success that will make you more successful financially, professionally and personally. You learn to achieve your goals, to “materialize” them (what that means, you learn in the book).

You get exact step-by-step instructions to your own personal financial freedom. So you avoid really frustrating mistakes right at the beginning. As a private person and / or as an entrepreneur, from Alex Fischer you will learn how to avoid these fatal mistakes and at the same time follow your passion – every day! In total, the book contains hundreds of learnings that will specifically help you lead a happier and more fulfilled life. Best of all, you can get the audiobook for free on Spotify and iTunes! Alex Fischer: Bestselling RADG (Review).

Alex Fischer (opening) live on the speaker stage. In the background his bestseller:

Tip. 100,000+ followers want new tips and tricks for taxes from Alex Fischer on a regular basis. Learn a lot about taxes, finance and real estate for free here. Click here to go to Alex Fischer Youtube. Once you’re ready, be sure to check out Tax Coaching:

Here you can get directly to the coaching and also other participants’ experiences.

- AF Steuercoaching – Application

- AF Coaching Experiences – Participant Interviews

4.9 / 5.0

4.9 / 5.0